![]()

![]()

![]()

![]()

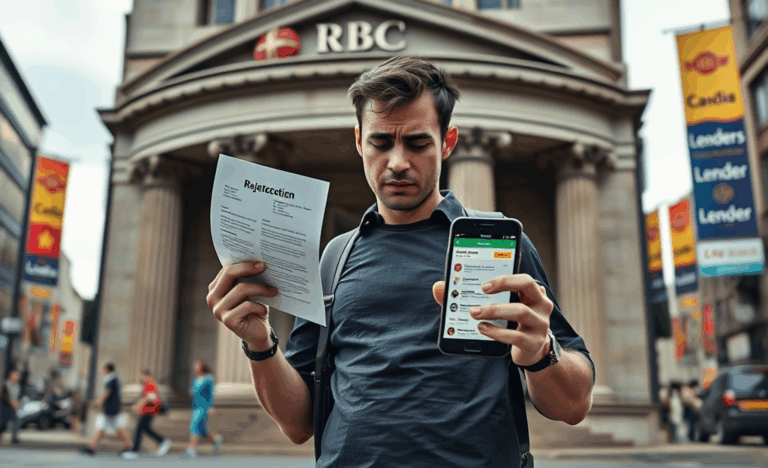

Explore Alternatives After Being Turned Down by RBC

Alternative Lending options have become a vital resource for individuals who face rejections from major financial institutions like RBC.

In this article, we will delve into understanding the reasons behind these rejections and explore the various lending alternatives available.

By examining offers from over 20 lenders, we aim to empower you with the knowledge needed to navigate financial solutions beyond traditional banks.

Discover the benefits of diverse lending opportunities and how they can help you achieve your financial goals, even when the bigger banks turn you away.

Facing a Loan Rejection? You’re Not Alone

Getting denied by a big bank like RBC can feel like a punch to the gut

You’ve spent time gathering documents, building credit, dreaming of home ownership—only to receive a sudden rejection.

The disappointment, stress, and confusion that follow are completely real and understandable.

These decisions often feel personal, even when they’re based on rigid lending formulas or automated scoring systems that overlook your unique financial story.

Rejection doesn’t mean you’ve failed—it simply means that one door closed, not all of them.

It’s important to understand that rejections from large banks are more common than you think.

Major lenders like RBC rely on traditional credit metrics and strict debt-to-income ratios.

Even small irregularities in your employment history or credit score could cause them to say no.

But here’s where things shift: You still have real, viable options.

Alternative lenders, including B-lenders, credit unions, and private providers, operate outside of these rigid frameworks and evaluate your application more holistically.

According to WOWA’s guide on alternative mortgage financing, Canadians turned away by big banks still have access to more than 20 reputable lenders who may say yes when others have said no.

So don’t give up.

Keep reading and discover how you can turn a rejection into a new opportunity.

Why Major Banks Like RBC Decline Applications

Credit Score Thresholds Most major banks, including RBC, set specific credit score requirements for loan approval.

According to RBC Credit and Borrowing Insights, a higher score reflects a lower risk, which is critical for automatic approvals.

Applicants with scores below 670 can face automatic disqualification regardless of other financial strengths.

RBC Loan & Credit Guidelines, 2023 recommend maintaining good credit behavior over time to meet their thresholds.

Income Verification Banks like RBC rely on verifiable income sources to ensure repayment reliability.

If income is inconsistent or unverifiable, even strong applicants may be declined.

RBC commonly requests pay stubs, tax documents, or letters of employment to confirm earnings.

As highlighted in Scotiabank’s Application Requirements, this is a standard industry-wide practice.

RBC Loan & Credit Guidelines, 2023 outline how missing documentation can stall or cancel applications.

Debt-to-Income Ratios This ratio reveals how much of your income goes toward debt repayment.

RBC applies conservative debt thresholds to mitigate default risk.

Even with a high income, if existing debts occupy a large portion of it, RBC may view the applicant as financially overextended.

Their risk review prioritizes both loan size and existing obligations.

RBC Loan & Credit Guidelines, 2023 stress the need for well-balanced borrowing behavior.

Employment Stability Employment history serves as proof of consistent income.

RBC prefers borrowers with long-term, full-time positions over gig or contract workers.

As discussed in forums like RBC Mortgage Preapproval Rejection Threads, some applicants face rejection despite high credit scores due to short job histories.

RBC Loan & Credit Guidelines, 2023 indicate that job longevity is central to loan evaluations.

Internal Risk Models Beyond public metrics, RBC employs proprietary algorithms to assess loan applications.

These models factor in undisclosed variables including economic conditions and portfolio exposure.

It means borrowers rejected by RBC may appear qualified on paper, yet fall outside their current approval strategies.

As with most large lenders, RBC Loan & Credit Guidelines, 2023 support using these tools for broader portfolio risk management.

The Alternative Lending Landscape in Canada

More than 20 alternative lenders in Canada now offer viable options to applicants rejected by large banks like RBC.

These lenders include credit unions, fintech firms, and specialty finance companies that prioritize individualized underwriting over rigid eligibility rules.

Their lending criteria allow greater flexibility in factors like income verification or debt ratios, opening the door to borrowers who may not meet traditional benchmarks.

With the rise of digital platforms, qualified applicants can now secure financing in a fraction of the time offered by banks.

This convenient and inclusive lending system results in tailored solutions that emphasize borrower needs over institutional thresholds.

Instead of being ruled out by standardized credit models, borrowers benefit from more holistic evaluations.

This shift toward applicant-focused lending not only increases access to financing but also fosters innovation through technology-driven decision making.

| Lender Type | Key Benefit | Typical Turnaround |

|---|---|---|

| Credit Unions | Greater personal consideration | 3–5 business days |

| Fintech/Online Lenders | Rapid online processing | 24–48 hours |

| Peer-to-Peer Platforms | Investor-borrower matchmaking | 2–4 business days |

| Specialty Finance Companies | Flexible credit requirements | 1–3 business days |

Comparing Multiple Offers to Secure the Best Deal

After a rejection from a major bank like RBC, it’s crucial to take a proactive approach by comparing offers from multiple lenders.

Begin by reaching out to various institutions and requesting personalized quotes that clearly list annual percentage rate (APR), term length, associated fees, and prepayment privileges.

Use a trusted online comparison platform such as Ratehub’s mortgage tools to quickly evaluate up-to-date offers across over 20 different lenders.

Review the APR closely, as it reflects both the interest rate and added fees, offering a more accurate cost estimate than interest rate alone.

Some lenders may offer a low base rate yet bury higher fees within the contract.

Confirm the lender’s credibility by consulting customer reviews, licensed broker associations, and provincial regulator databases.

- Interest rate (APR)

- Total mandatory fees

- Repayment flexibility options

- Loan term conditions

- Early payment penalties

Once you’ve narrowed down options, don’t hesitate to negotiate.

Even if you’ve been rejected once, other lenders may welcome your application with competitive alternatives.

Read all documents thoroughly, validate all terms, and stay informed on your provincial lending laws to protect your financial interest.

Unlocking the Advantages of Diverse Lending Options

Exploring a wider range of lenders can offer Canadians substantial financial relief compared to traditional bank experiences.

When big banks such as RBC say no, alternative lenders across Canada often step in with higher approval odds and a more human approach to applications.

These non-bank institutions assess borrowers through personalized underwriting, not just rigid credit formulas.

As a result, more individuals and small businesses gain access to the funds they need.

“Alternative lending promotes financial inclusion by offering flexible capital access that some traditional lenders can’t match,” says Stan Prokop, a contributor on LinkedIn

Through simplified processes and reduced paperwork, borrowers can receive quicker funding—often in days, not weeks.

Beyond the speed, terms can rival or even outperform big bank offers, especially when banks hesitate.

By considering over 20 lending sources, individuals unlock competitive rates, responsive service, and a path to greater financial confidence and stability

Alternative Lending provides a pathway to financial solutions when traditional banks say no.

By exploring various lenders, you can find options tailored to your needs, ensuring you don’t miss out on opportunities that may otherwise be unavailable.