![]()

![]()

![]()

![]()

Have You Seen 2025’s Viral Online Loan Trend

Online Loan trends have taken a dramatic turn in 2025, with viral loan shark apps emerging as a significant concern.

These applications not only threaten your financial stability but also pose risks to your personal reputation and security.

As this troubling phenomenon gains traction, it’s essential to understand its implications.

This article will delve into the dangers associated with loan shark apps, the importance of safeguarding your personal information, and how to choose safe and trusted lending options.

Stay informed to avoid defamation and navigate the lending landscape responsibly.

The Unexpected Rise of Digital Micro-Lending in 2025

What started as a small convenience has unexpectedly exploded into a viral trend that’s sweeping across digital platforms—online loans are being taken out with just a few taps, often in under a minute.

From TikTok breakdowns to Instagram reels glamorizing the ease of instant approvals, consumers have become both obsessed and alarmed.

Have you noticed posts showcasing unbelievable “loan hacks” or friends casually mentioning how fast they got cash through a trendy app? It’s happening everywhere and it’s turning heads fast.

While major outlets like The Financial Brand report a documented rise in personal lending, what’s truly shocking is how this social buzz has outpaced even traditional loan marketing.

Blink, and you might miss the next viral loan app promising freedom but risking your financial safety.

So if you’ve spotted this loan phenomenon online, you’re definitely not alone

What Exactly Makes These Loans Go Viral?

The viral surge in online loans during 2025 stems from a mix of compelling digital enhancements and modern consumer psychology.

Speed and convenience are no longer luxuries, they’re expectations.

Many mobile-first lending platforms boast instant credit decisions, while some influencers openly promote them, reinforcing trust by association.

Additionally, well-designed apps with intuitive features create a frictionless borrowing experience.

These ingredients have catalyzed explosive adoption, pushing more cautious users toward the trend.

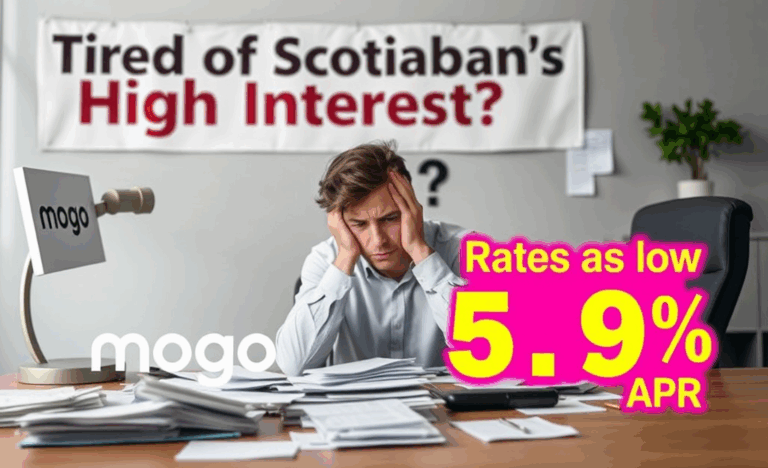

But while the appeal is undeniable, the Federal Trade Commission reminds consumers that not all offers are safe, with some disguising predatory terms behind flashy facades.

Still, the psychological triggers of speed, convenience, and social proof prove powerful, especially among digitally native populations looking for short-term liquidity.

All this has led to a phenomenon that continues to grow, despite rising concerns over financial safety and data privacy risks.

| Feature | Why It Hooks Users |

|---|---|

| Quick approvals | Funds in minutes, satisfying instant-gratification culture |

| Influencer endorsements | Boosts perceived trust through social proof and familiarity |

| Mobile-first interfaces | Streamlined apps offer zero learning curve and ease of use |

| Soft credit checks | Minimizes fear of hurting credit scores during loan shopping |

| Customizable loan terms | Gives users a sense of control and financial flexibility |

Why Social Media Rocketed the Trend to Fame

The explosive rise of the viral online loan trend in 2025 can be directly linked to the fusion of evolving technology and shifting social behavior, creating the perfect storm for mass digital adoption.

- Influencer-driven trust formed the foundation, as creators on platforms like TikTok and Instagram leveraged their credibility to promote instant loans, embedding lending into everyday conversations

- Frictionless fintech integrations through APIs allowed app developers to embed seamless borrowing experiences into lifestyle apps, making loans feel like just another digital convenience

- Algorithmic targeting used user behavior data to deliver highly personalized loan offers at critical financial moments, increasing conversion and virality

- Gamified loan interfaces mimicked mobile games and social platforms, stimulating engagement and reducing perceived financial risk

- The influence of social media trend culture framed borrowing as status-flexing, transforming debt into a digital lifestyle badge

- Instant identity verification and AI-powered risk assessments eliminated lengthy approval processes, encouraging near-instant gratification

- Viral sharing incentives embedded in rogue lending apps encouraged users to spread links in return for credit boosts, fueling organic reach and endangering privacy

Risks That Lurk Behind the Hashtags

The viral online loan trend flooding social feeds in 2025 may seem like a quick financial fix, but hidden beneath the trending hashtags are serious threats to consumer safety.

Underlined strong text like predatory interest rates lure borrowers with promises of instant cash, only to surge past sustainable repayment levels once you’re locked in.

What appears to be an easy way out can quickly spiral into overwhelming debt, especially with algorithmic loan apps that approve rapidly but charge triple-digit APRs.

According to a 2024 FinRisk survey, 34 percent of quick-loan users missed their first payment, pushing many into penalty cycles they couldn’t escape.

Beyond financial strain, data privacy is increasingly compromised by these viral loan platforms.

Many require access to contact lists, message histories, and even GPS data.

Fraud prevention experts at FinTalk report a sharp rise in mobile loan apps harvesting personal information under vague consent forms.

This opens the door to digital defamation and extortion tactics, making a borrower’s reputation as vulnerable as their wallet.

Staying with licensed and regulated lenders isn’t just wise—it’s critical when navigating viral financial solutions.

Spotting Legit Lenders Before You Click “Apply”

- Check app-store reviews from actual users to spot red flags like hidden fees, aggressive loan collection tactics or instant approvals with little verification—common signs of shady viral loan apps

- Verify lender licensing through your local financial authority or tools like the Federal Trade Commission to ensure the lender complies with regulatory standards and avoids illegal lending practices

- Look for secure encryption protocols on loan platforms such as HTTPS and data privacy disclosures that showcase how your personal details are stored and protected

- Test customer service responsiveness by sending a quick query or calling their helpline—trustworthy lenders will respond promptly and clearly, not with vague or automated replies

- Confirm terms and repayment structures are clearly laid out before applying—hidden interest terms are a trap used by many of the viral lending players of 2025 emerging during the online loan craze

In conclusion, staying vigilant against the dangers of loan shark apps is vital for your financial well-being.

By choosing safe lending options and protecting your personal information, you can avoid the pitfalls associated with viral online loan trends.